2023 4th Quarter Newsletter

Preparing Your Finances in Times of Disaster

The Maui wildfires were a tragic reminder of how we can lose everything in an instant. Our hearts go out to all who are affected by the devastation. While it is impossible to fully prepare for these types of disasters, there are a few things we

can do before and after to mitigate financial loss.

Precautionary Steps

- Assess and gather all your important financial documents.

- Keep secured, digital copies of important documents such as birth certificates, identification, insurance cards, important medical records, and more.

- Review your insurance policies and finances.

- Update your information and plan through each huge life event (marriage, children, etc.).

- Determine if your coverage is enough.

- Maintain and update your homeowner’s/renter’s insurance coverage, particularly for homeowners that no longer have a mortgage or HELOC.

- Budget to always have three to six months of savings as your emergency fund.

- Prepare a physical emergency kit.

- Keep all your essential documents secured and together so that you can easily take them during an evacuation (if safe to do so).

- Keep some cash in your kit to use in case card systems are down.

- Take photos of your property, this will help with damage assessment if a disaster strikes.

After Disaster

- Take care of the essentials first. Ensure everyone is safe, and find shelter and necessities.

- Know who to contact and check for your relief options. Be wary of scams and fraud. Here are trusted organizations:

- Federal Emergency Management Agency (FEMA)

- American Red Cross

- Salvation Army

- Inform your financial institutions that you have been affected.

- Contact your insurance companies to report damages.

International Credit Union Day 2023

Join us in celebrating International Credit Union Day! From the member benefits to being part of our Credit Union family, there is much to celebrate. This year, International Credit Union Day is on October 19 and we will have various Hickam FCU items for you to collect at your favorite branches. Leading up to October 19, we'll be sharing various fun facts and giving you all a sneak peek of awesome giveaways from our branches on ICU Day! Follow our blog or follow us on Instagram!

Holiday Schedule

November 10, 2023: CLOSED, Veteran’s Day (Observed)

November 11, 2023: OPEN, regular hours

November 23, 2023: CLOSED, Thanksgiving Day

November 24, 2023: OPEN, regular hours

December 25, 2023: CLOSED, Christmas Day

January 1, 2024: CLOSED, New Year’s Day

2024 Annual Meeting, Virtual

The Hickam FCU Annual Meeting and Membership Celebration will continue to remain virtual in 2024. Members will be allowed to attend the Annual Meeting at the Pearl City Main Office. The Membership Celebration will be held online and through our seven

branches. Please keep an eye out for the full details in our next newsletter.

Making the Community Better, Together.

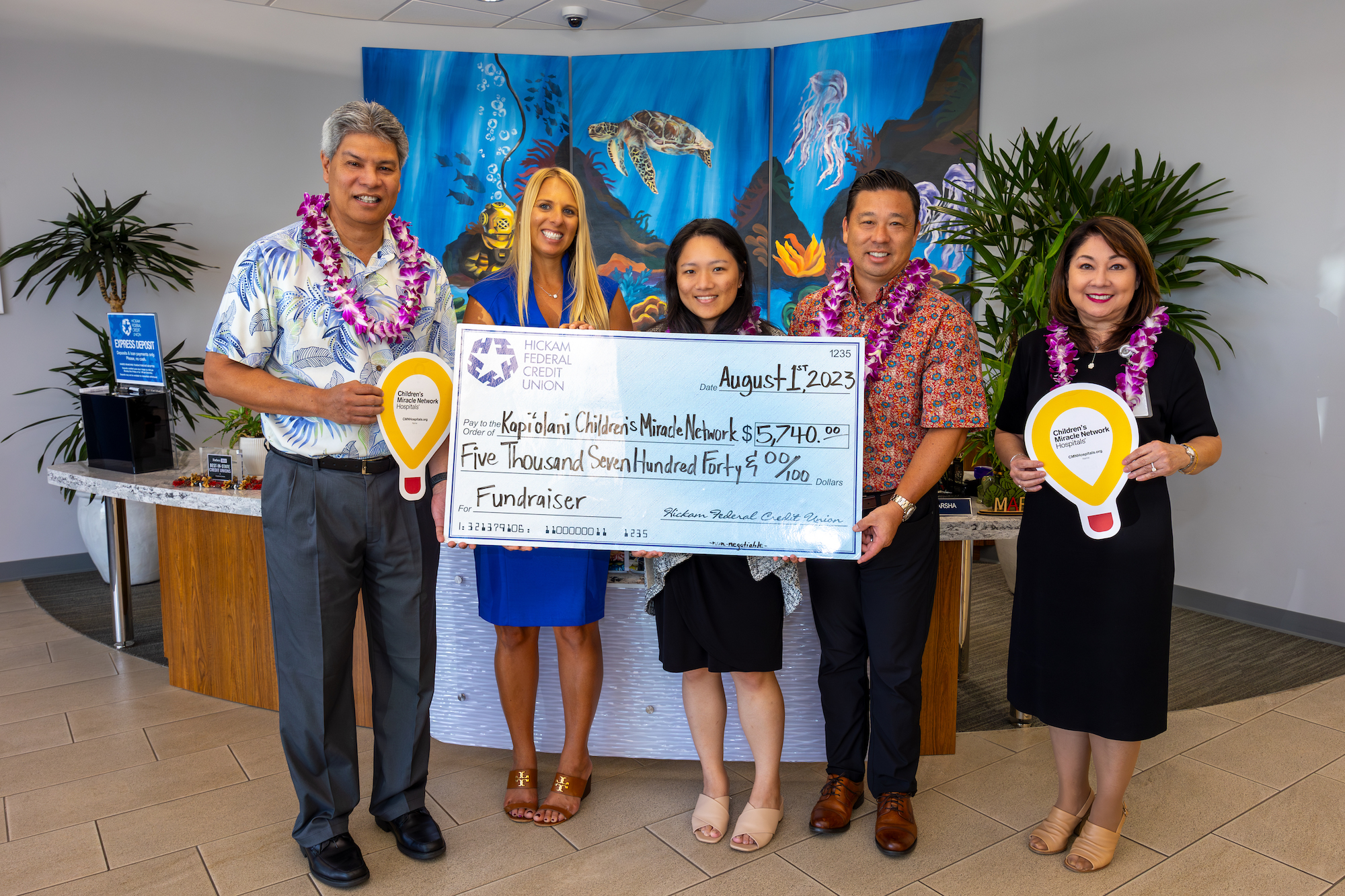

Children's Miracle Network

The 2023 Children’s Miracle Network Hawai‘i Champion is Kalley-Mae Yee. If you’ve heard anything about her story, you know that the team at Kapi‘olani Medical Center does wonders for our local families. Mahalo to all who donated

to our CMN Fundraiser, these funds go right back to helping more local babies grow into strong kids.

With your help, we were able to raise $2,870. Hickam FCU was also selected to receive a Miracle Match from CO-OP which bumped the total donation to $5,740!

Hawai'i Foodbank

We began our Hawai’i Foodbank fundraiser just like any other year, raising funds for a crucial community resource. Just a week into our fundraiser, the Maui wildfires disrupted everything. Quickly, we pivoted and encouraged our members to direct funds toward Maui Foodbank via our fundraiser. Our goal was $3,000 and with all your help, we were able to raise $7,300. Thank you from the bottom of our hearts!

Medicare Made Easy

Mahalo to Taryn Kumamoto for hosting two Medicare Made Easy webinars for our Hickam FCU community. We hope that all who attended the webinars gained valuable knowledge regarding Medicare. For those who could not make it, or need additional assistance, please feel free to contact Taryn.

| Taryn Kumamoto, MBA Premier Benefit Consultants (PBC) Mobile: 808.387.3564 Office: 808.738.4500 Email: [email protected] Web: pbchawaii.com/taryn |

Mililani Town Association Senior Fair

Mahalo to all who stopped by our table at the Mililani Town Association Senior Fair on September 9th. We enjoyed seeing your faces and informing you all about the services we can provide.

Island Wealth Management Webinars

Mahalo to Scott Nishida, AIF® and John Sulzicki of Capital Group for hosting the “Investment Fundamentals: Lessons from the Past 88 Years” webinar on September 16th. We hope all attendees gained valuable insight. If you would like to learn more, please reach out to Scott Nishida, AIF®.

He will also be hosting a free "Social Security Savvy" webinar with guest Kawika Malama of Corebridge Financial on Saturday, November 4th at 10:00 a.m. HST. Hickam FCU members and friends are welcome to register for the Zoom webinar here.

You can also schedule a complimentary, no-obligation consultation with our Island Wealth Management Financial Consultant Scott Nishida, AIF® either virtually or at our Pearlridge Branch. Please schedule an appointment through Scott’s calendar.

| Scott Nishida, AIF® Financial Consultant, Island Wealth Management Email: [email protected] Pearlridge Branch Office Phone: (808) 440-8128 Island Wealth Management Office Phone: (808) 525-7200 Island Wealth Management Office Fax: 808-525-7220 |

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/

SIPC). Insurance products are offered through LPL or its licensed affiliates. Hickam Federal Credit Union and Island Wealth

Management

are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Island Wealth Management, and may also be

employees of Hickam Federal Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Hickam Federal Credit Union or Island Wealth Management. Securities

and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed | Not Credit Union Deposit or Obligation | May Lose Value |

|---|

The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

John Sulzicki and Capital Group is not affiliated with or endorsed by LPL Financial and Island Wealth Management.

Kawika Malama and Corebridge Financial is not affiliated with or endorsed by LPL Financial and Island Wealth Management.

Featured Member Story

"Every time we visit Hickam FCU (5x's a month), Erika is consistent with her superb customer service. We feel valued and really like family. Please recognize her for making us feel like we're at home.” Faleiva, member since 2004

Read more Hickam FCU Member Stories by searching #HickamFCUMemberStories on Facebook or Instagram, or by visiting www.hickamfcu.org/memberstories. If you would like to share your story, please submit it at www.hickamfcu.org/memberstories/#submit.

Avoid Falling for Social Engineering Scams

Around mid-September, you may have noticed many machines and online systems were down if you were on the “Ninth Island”. A couple of the largest casino chains in Las Vegas became victims of a ransomware attack. The hackers gained access

to their systems and demanded the chains to pay up. This incident cost millions and caused even more in lost revenue. How did the hackers gain access? They used social engineering, which is when attackers manipulate and deceive

victims to gain control of their devices and/or systems and steal their identity and information.

While an incident of this scale makes it to the news, ordinary individuals are also affected by social engineering attacks daily. It’s important to identify social engineering situations early to prevent leaking your information and access to your accounts. Attackers may attempt to act like a family member, friend, coworker, public figure, or trusted organization (e.g. financial institutions, charities) via email, phone calls, and even in-person interactions to deceive you and gain your trust. If the situation feels suspicious, remember to always find another way to verify what is going on. Here are a few examples:

- Friend requests on social media: Only accept friend requests from people you know. Even if the request is from someone you know, be sure to check their profile for red flags, such as recently created accounts, questionable content, or immediate requests for something. To verify the account's authenticity, contact the person through another method.

- Online listings: When selling items online, avoid sharing your personal phone number and email address. Hackers often use this information to attempt unauthorized access to your accounts through the "forgot password" link. Use the built-in messaging tools on platforms like Facebook Marketplace and Craigslist's email relay system to communicate with potential buyers.

- Spoofing: Hackers may impersonate employees of companies you interact with and request sensitive information like your card number. Do not provide such information over the phone. Instead, hang up and contact the company using their official contact information to verify the request.

As always, be sure to monitor your accounts and credit for any suspicious activity. At Hickam FCU, we recommend you enroll in Online Banking and download our mobile app. You can check your accounts from anywhere at any time. Additionally, we provide a free credit score tool for you to keep tabs on your credit! Learn more at https://www.hickamfcu.org/benefits-services/online-services/online-banking.