2023 3rd Quarter Newsletter

Hickam Federal Credit Union's Green Energy Initiative

Hickam Federal Credit Union is going green! We are excited to announce that in the coming months, we will be installing a rooftop solar system at our Pearl City Headquarters. Our green energy initiative is a way to demonstrate the credit union’s

commitment to the environment and aligns with our goal to reduce carbon footprint emissions and contribute to a more sustainable future.

“We are thankful to the community partners who worked with us to make this initiative a reality and are proud to help the State of Hawaii inch closer to their renewal energy goals,” says Scott Kaulukukui, President and CEO of Hickam FCU.

The rooftop solar system will include 287 solar panels that is estimated to produce 185 megawatt hours of energy per year, which will offset over 142 tons of CO2 emissions per year. That’s equivalent to eliminating nearly 350 barrels

of oil or providing enough energy to power 380 homes for a month or 31 homes for an entire year.

In addition to making a positive impact on the environment, the installation of a solar system will reduce energy usage costs, with the savings being used to help improve and enhance member products and services. Hickam FCU is proud to offer other green

energy initiatives, including:

- Electric vehicle charging stations located at our Pearl City Branch Headquarters. Stop by and plug in today!

- Discounted rates for Eco-Auto Loans to finance the new or used electric or hybrid vehicle of your dreams.

- Low-Rate Eco-Personal Loans to help with photovoltaic or solar water heater system installation.

- Free e-Statements, which allows members to receive financial statements and notices electronically instead of being printed on paper and mailed. Start reducing waste today!

We hope that our green energy initiative will have an impact and inspire others in our community to also adopt environmentally friendly practices.

Medicare Webinars

If you are approaching age 65, you will have some choices regarding your health insurance and Medicare eligibility. Or, if you are still working and are past the age of 65, you may be wondering how to start planning for your medical insurance needs.

With all the rules and options surrounding Medicare, you may be wondering how to get started and what are the best choices for you.

In this Medicare Made Easy presentation, Taryn Kumamoto will walk you through the Medicare maze in a clear and easy-to-follow presentation.

Taryn Kumamoto is a leading expert for over fifteen years in this industry helping clients choose the right Medicare plan for them.

During this presentation, she will cover:

- What is Medicare?

- How much does it cost?

- What kind of supplemental plans do I need?

- What are late enrollment penalties and how to avoid them?

- What are the deadlines for enrolling?

We invite you to join us for this free webinar to educate you on Medicare and answer all your questions from an expert! Please use the links below to register and feel free to share the links with your friends.

Session 1 Wednesday, August 23, 2023 6:00 p.m. HST on Zoom | Session 2 Saturday, September 2, 2023 9:00 a.m. HST on Zoom |

Unleash the Power of Savings Winner

Saving money paid off for our lucky Unleash the Power of Savings winner Ryken! Youth members who made a $20 or more savings deposit and submitted the entry form were entered. Ryken was randomly selected and won a year-long family membership to the Honolulu

Zoo. He also won a symbolic adoption and chose to adopt the Fennec Foxes (Aukai, Moana, and Vaitea)!

Social Media Blitz

From borrowing to saving, we hope that being part of the Hickam FCU ohana has helped you with your financial journeys. Help spread the awesomeness of credit unions by participating in the #ILoveMyCreditUnion Social Media Blitz on July 28th! Here’s what you can do:

- Follow us on Instagram, Threads, Facebook, and LinkedIn

- Share your member story on social media and use the #HickamFCUMemberStories and #ILoveMyCreditUnion hashtags

- Leave a review of your favorite branch on Yelp or Google

Hickam For All

Hickam FCU was recently featured on Forbes, Fortune, and Entrepreneur. Read the full article here.

Making the Community Better, Together.

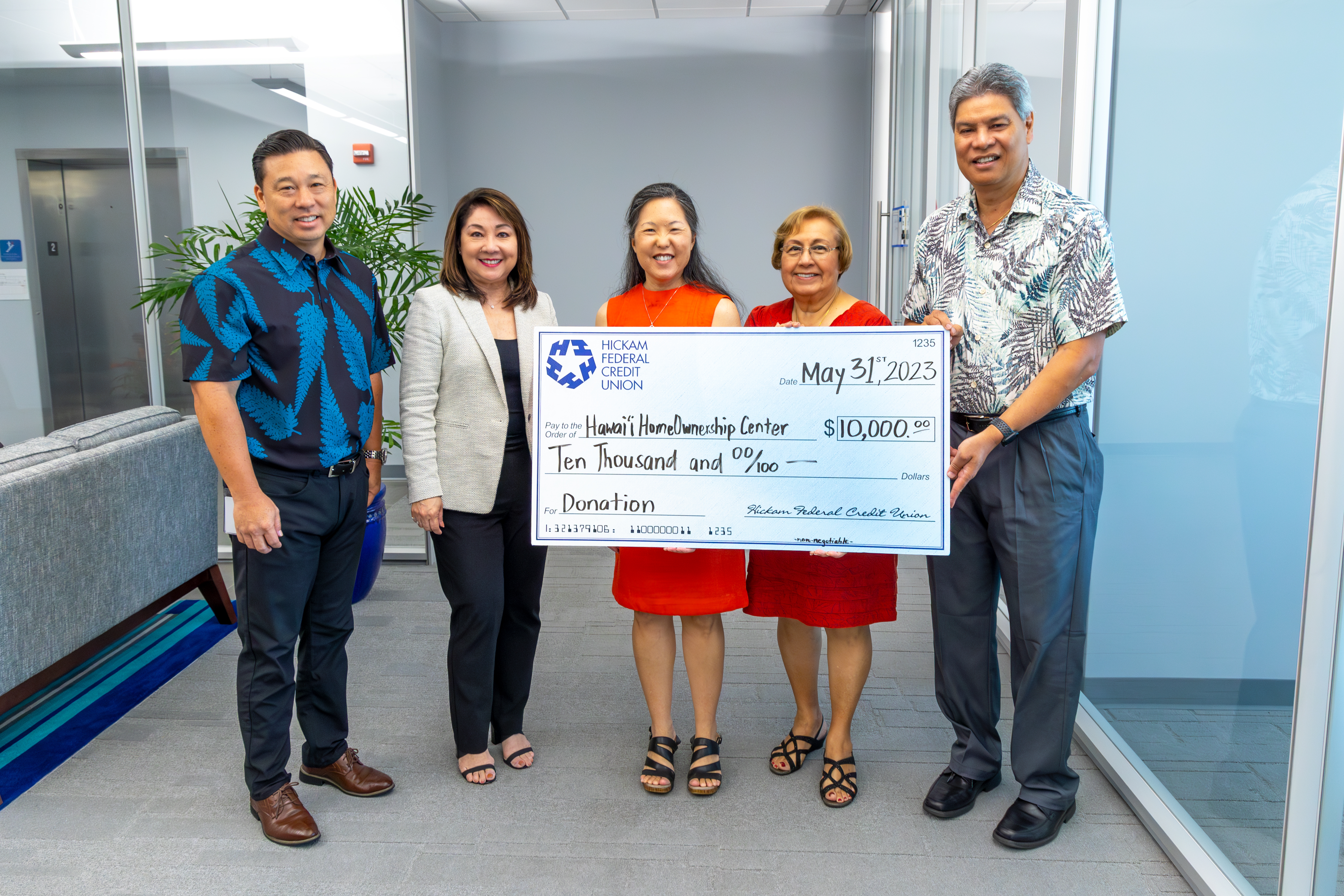

Hawai'i HomeOwnership Center Donation

Homeownership in Hawai'i may feel impossible, however, organizations like the Hawai'i HomeOwnership Center (HHOC) have made it their goal to get as many residents into their first homes as possible. Hickam FCU is proud to support HHOC with a $10,000 donation made possible with a donation match from the Federal Home Loan Bank (FHLB) of Des Moines Member Impact Fund.

The Hawai'i HomeOwnership Center is a nonprofit dedicated to providing education, information, and support to create successful first-time homebuyers in Hawai'i. The Center offers homebuyer education courses, workshops, and other resources for families from all types of backgrounds. However, their vision is to substantially increase the number of successful homeowners from low to moderate-income families. Hickam FCU believes that the Center’s mission and vision align with the credit union’s core values of caring, integrity, and commitment. Hickam FCU’s support of Hawai`i HomeOwnership Center is part of the credit union’s efforts to see more first-time homebuyers achieve their goals of purchasing their own home in Hawai'i.

Children's Miracle Network

One in 10 babies are born prematurely in Hawai'i. There’s a good chance you may know a family that has faced this challenge. Hospitals like Kapi'olani Medical Center are crucial for ensuring that these babies grow up as strong kids. This year, the Children’s Miracle Network Hawai'i Champion is Kalley-Mae. She was born at 23 weeks into the pregnancy and weighed just under two pounds. Against all odds, she persevered through multiple surgeries, blood transfusions, and other challenges within the first six months of her life.

Today, Kalley-Mae is a bubbly four-year-old who loves T-ball, running, and dancing! Mahalo to all who donated to our CMN Fundraiser. Your contribution will help more babies grow into strong kids like Kalley-Mae. We are proud to have raised $2,870 for Children’s Miracle Network Hawai'i. Additionally, we have received a match from CO-OP Miracle Match to bring our total donation to $5,740!

Stuff the Bus Supply Drive

Kids look to summer as a time of fun, adventure, and no homework. Parents are hitting the stores with supply lists in hand. Unfortunately for some families, supplies can be considered a luxury. Hickam FCU joined other merchants in helping collect school supplies for keiki in need as part of Pearlridge Center’s Stuff the Bus program. Our Pearlridge and Pearl City Branches collected supplies like pencils, pencil boxes, markers, crayons, backpacks, pens, folders, paper, and more. Mahalo to all who supported this supply drive!

Wai'anae Keiki Springfest

|  |  |

The Hickam FCU team was glad to be back at the Wai'anae Keiki Springfest to provide Keiki IDs to our families on the West side. The event was held at Kamehameha School’s Community Learning Center in Mā'ili on April 29th. A total of nine Hickam FCU staff volunteers created 83 Keiki IDs.

2023 College Scholarship Program Awardees

Hickam Federal Credit Union is proud to support the educational journeys of our members. Five student members were awarded $1,000 scholarships each for our 2023 College Scholarship Program. These deserving students were selected by our Scholarship Program Committee after a thorough review of their applications, transcripts, recommendations, and more.

Jenna J., Biology

Kealaokamaile P., Business

Patricia F., Biology

Sean M., Environmental Science

Siena E., Natural Resources & Environmental Management

Congratulations and we cannot wait to hear about your future accomplishments! For those interested in applying next year, please click here to view the requirements.

Volunteer Income Tax Assistance

From February through April, Hickam FCU staff assisted and prepared tax returns at the Pearl City Branch. These efforts were done as part of the Volunteer Income Tax Assistance (VITA) program which provides free income tax preparation services to low-income individuals, individuals with disabilities, and the elderly. In total, Hickam FCU was able to assist with processing a total of $74,200 in federal refunds and $11,500 in state refunds.

Featured Member Story

“My son was in need of a car, his old car broke down unexpectedly and it was very expensive and impractical to repair. He needed a car immediately. A visit to Hickam FCU was a great decision. Branch Manager, Shaleia, was very welcoming and treated us like ohana from the very beginning. It was like talking with someone from the old neighborhood. She provided us helpful information and options for a loan that would fit my son’s needs and budget. She made the application process so easy for us, and we were out of there in no time, ready to go car shopping immediately! Shaleia’s accommodating demeanor turned a frustrating and unpleasant situation into a positive experience. Not only did we get a loan at a great rate, we also gained a new friend. Mahalo Shaleia!” Chris, member since 2023

Read more Hickam FCU Member Stories by searching #HickamFCUMemberStories on Facebook or Instagram, or by visiting www.hickamfcu.org/memberstories. If you would like to share your story, please submit it at www.hickamfcu.org/memberstories/#submit.

Check Fraud is on the Rise

In 2022, a whopping 680,000 cases of check fraud were reported to the Financial Crimes Enforcement Network (FinCEN), almost double the number of reports in 2021. It turns out that our mail system is a major weak point when it comes to check security. In fact, the U.S. Postal Inspection Service discovered that incidents of mail theft doubled in 2021 compared to the previous year. What's concerning is that checks can be easily stolen from the mail and altered to make them payable to someone else. It's crucial for us to be aware of this issue and take steps to protect our financial documents.

With check fraud on the rise, here are some tips you can follow to avoid the frustration and stress that come with being a victim.

- Monitor your account balances for suspicious activity. Instead of waiting for your statements, use Online and Mobile Banking to get real-time updates.

- Having financial information in the mail presents an opportunity for thieves to steal your financial identity. Opt for eStatements so that your information can be delivered to you in a faster and safer manner.

- Where possible, use electronic payments (via debit or credit card) rather than checks. Using cards is generally safer than writing checks, plus you can dispute fraudulent transactions.

- If you must mail a check, use security envelopes to mask what is inside. You may even want to put another piece of paper around the check. Do not write anything on the envelope that may indicate there is a check inside. Verify that the address you are sending the check to is the official address provided by a trustworthy business or individual. Finally, drop off your mail directly with the Post Office to avoid thieves stealing it from your mailbox or fishing it out of collection bins.