2022 3rd Quarter Newsletter

Island Wealth Management

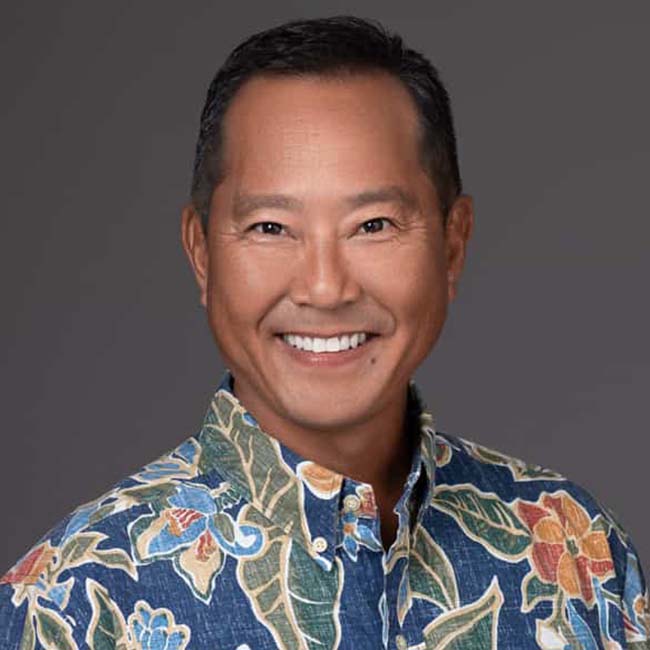

Island Wealth Management Financial Consultant Scott Nishida, AIF® at the Hickam FCU Pearlridge Branch.

You can now enjoy additional benefits as a credit union member! Island Wealth Management offers access to financial planning and investment services. Regardless of where you are with your finances, Island Wealth Management will help you address

your long-term financial goals.

The Island Wealth Management professional advisers can assist you with many services including mutual funds, long term care insurance, estate planning, individual stocks, life insurance, retirement planning, college savings plans,

and more.

You can schedule a complimentary, no-obligation consultation with our Island Wealth Management Financial Consultant Scott Nishida, AIF® either virtually or at our Pearlridge Branch. Please schedule an appointment through Scott’s calendar here.

| Scott Nishida, AIF® Financial Consultant, Island Wealth Management Email: [email protected] Pearlridge Branch Office Phone: (808) 440-8128 Island Wealth Management Office Phone: (808) 525-7200 Island Wealth Management Office Fax: 808-525-7220 |

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/

SIPC). Insurance products are offered through LPL or its licensed affiliates. Hickam Federal Credit Union and Island Wealth

Management

are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Island Wealth Management, and may also be

employees of Hickam Federal Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Hickam Federal Credit Union or Island Wealth Management. Securities

and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed | Not Credit Union Deposit or Obligation | May Lose Value |

|---|

The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Hickam Federal Credit Union Ranks #1 Credit Union in Hawaii by Forbes

For the second consecutive year, Hickam FCU has ranked on Forbes' Best Credit Unions in Hawaii list. This year, we are proud to announce that we have ranked first! Thank you to our loyal members who have helped us get here. Thank you for trusting us to be more than just your financial institution, but as a part of your greater community. We also want to express our gratitude to our Board of Directors and staff for consistently living out our core values of Caring, Integrity, and Commitment.

The rankings were determined by customer surveys collected by Forbes and market research firm Statista. The survey included questions about how members felt about their credit union in regards to trust, terms & conditions, branch services, digital services, customer service, and financial advice. We are committed to continually making it better, together.

Save Small, Dream Big Winners

|  |  |

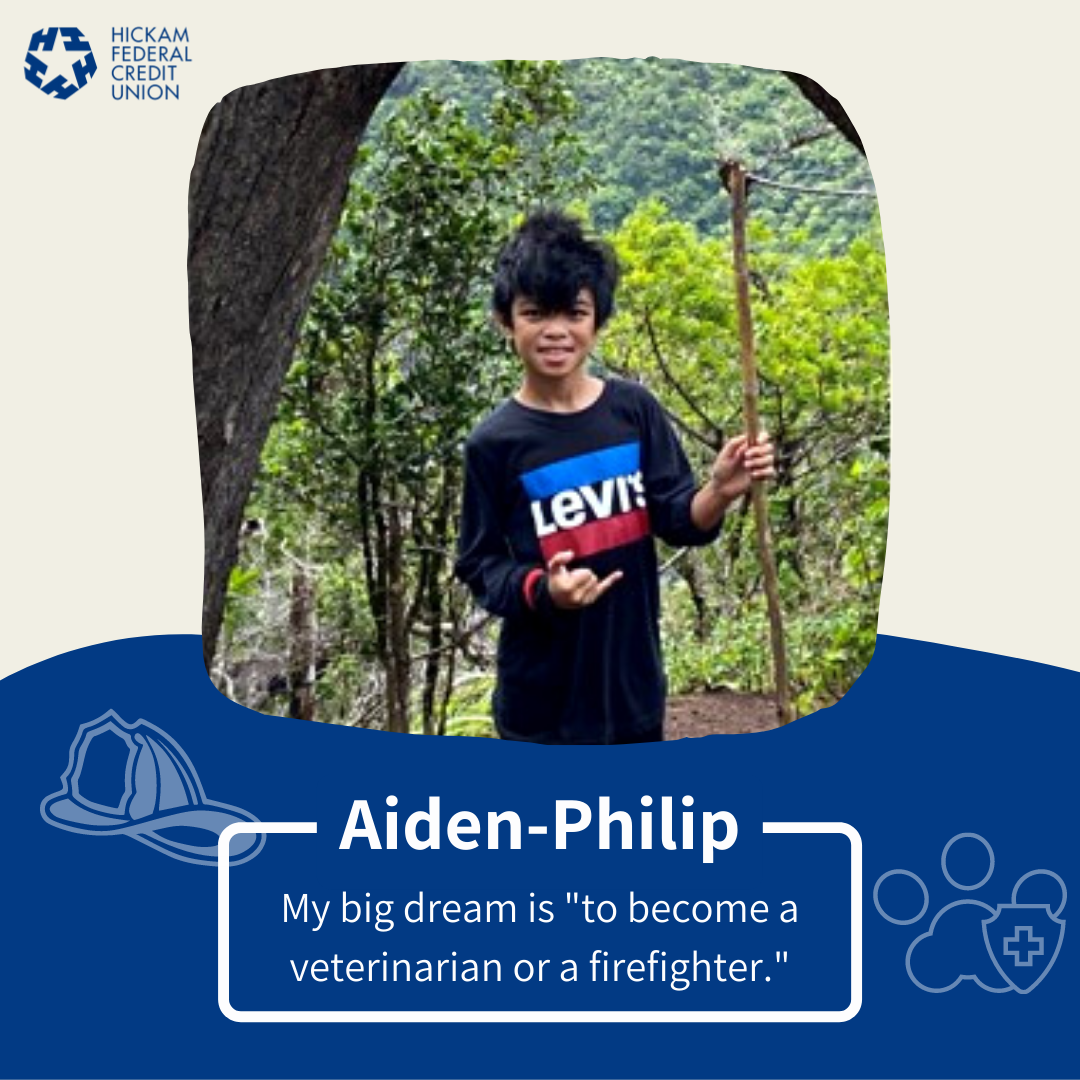

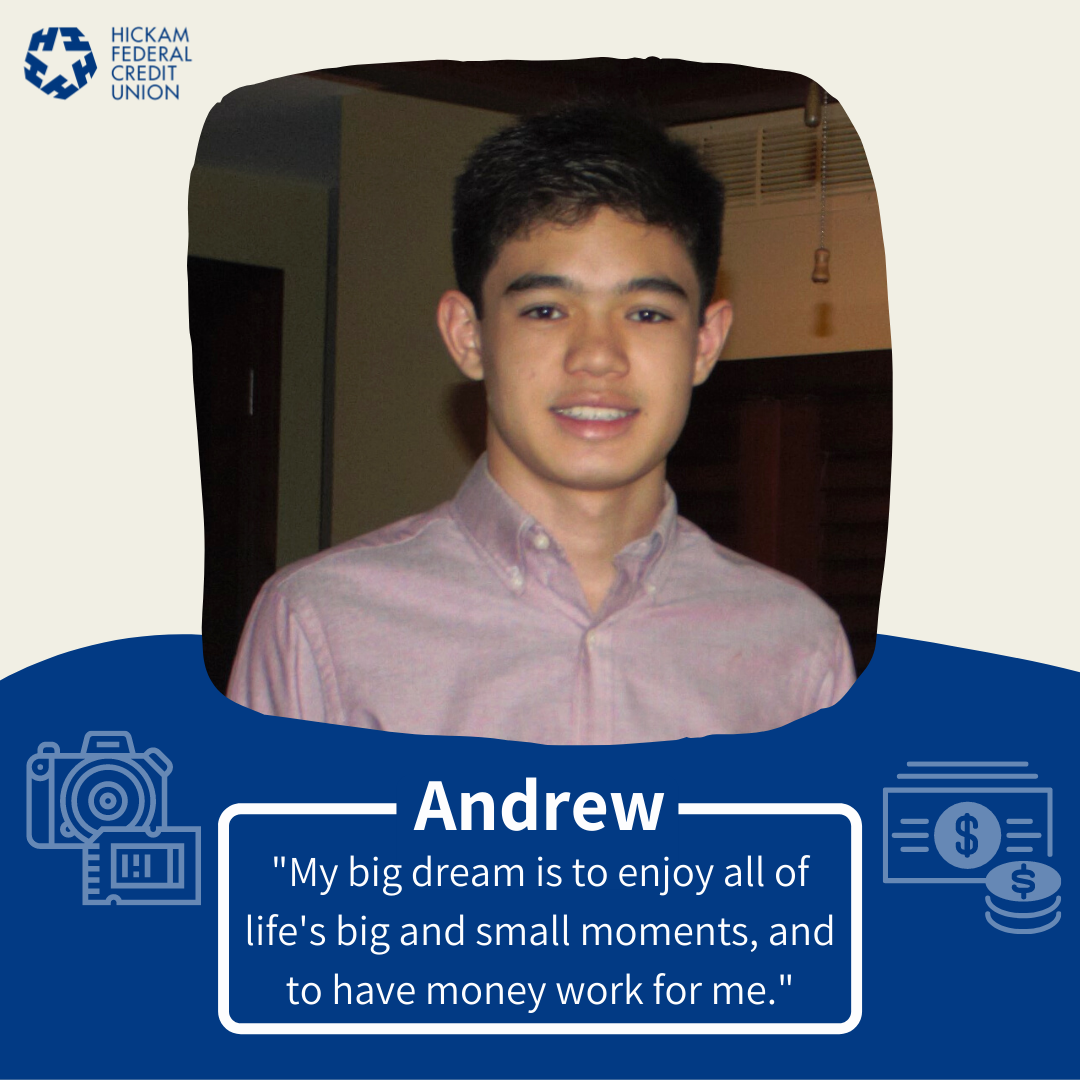

April was National Credit Union Youth Month and Hickam FCU held its Save Small, Dream Big Drawing to encourage younger members to start saving. To enter, participants had to deposit at least $10 into their savings account and tell us the big dream they were working towards.

Congratulations to our big dreamers!

- Aiden-Philip: My big dream is “to become a veterinarian or a firefighter.”

- Andrew: “My big dream is to enjoy all of life’s big and small moments, and to have money work for me.”

- Hi‘ilani: “My big dream is to become a makeup artist.”

As our participants proved, it’s never too early to start saving! Bring your keiki to any branch and set them up for their financial future.

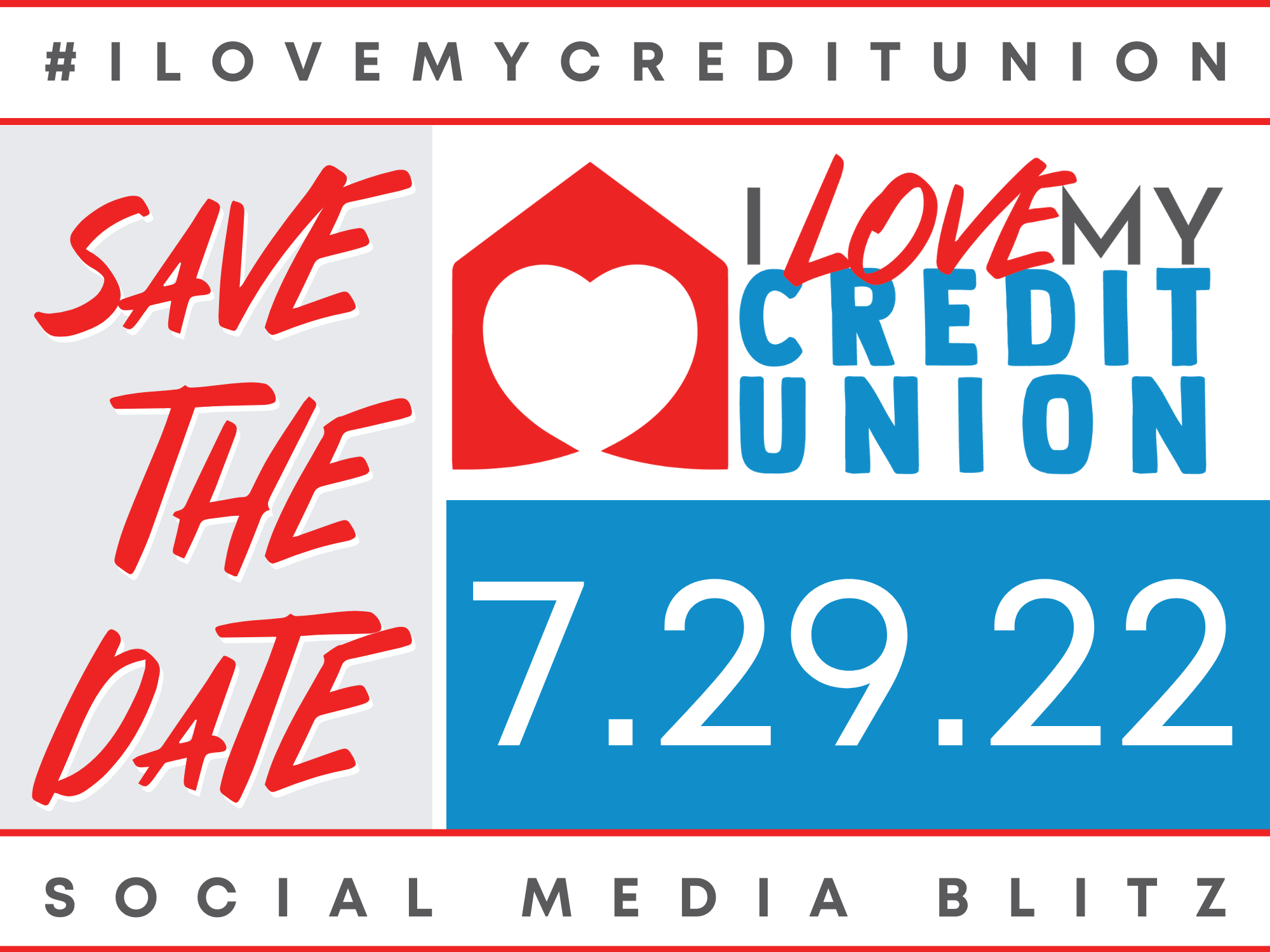

Join Us for the Social Media Blitz!

Save the date and make sure you follow us on Facebook and Instagram for our 2022 Social Media Blitz! We will be announcing a surprise activity happening on July 29, 2022.

Used Auto Loan Special

*Annual Percentage Rate (APR) disclosed for this special is the lowest rate available based on a 72-month term. Automatic Payment through a Hickam FCU deposit account is required for this promotional rate. Our standard, non-promotional rates will apply without setting up repayment via Automatic Payments from a Hickam FCU deposit account. ECO Auto Loan discounts for electric or hybrid vehicles do not apply to this promotion. Ask us about our special rates for electric or hybrid vehicles. Higher rates may apply depending on loan term, collateral, member's credit performance, and/or the cancellation of automatic payment. **Maximum loan amounts are based on 120% MSRP for Used Auto Loans which may include tax, license, GAP, extended warranty or other auto related add-ons. At 3.74% APR, the monthly payment amount for a $30,000 Used Auto loan with a 72-month term would be $465.86. No refinancing of existing Hickam FCU auto loans for this promotional rate. Other rates and terms available. ***Same-day loan decisions for completed applications received prior to 12:00 p.m. Monday thru Friday during HFCU business hours. Loan decisions for completed applications received after 12:00 p.m. or on Saturday, Sunday or holidays will be made on the next business day. All loans are subject to qualifications and approval. Certain terms and conditions apply. Rates are subject to change without notice. Hickam FCU membership required. Offer effective 7/1/2022 thru 9/30/2022.

Making the Community Better, Together.

Earth Day Beach Clean-Up

On Sunday, April 24, 2022, a team of Hickam Federal Credit Union staff and family members rolled up their sleeves and sifted sand for Sustainable Coastlines Hawai'i's Annual Earth Day Festival. More than 1,000 volunteers attended the festival which

took place at Waimānalo Beach Park.

With a sand sifter, shovel, and multiple reused feed bags in hand, our team got to work. Sand is placed through the sifter to draw out microplastic pieces. These are plastics that have been battered down by the environment into tiny pieces. When left

alone, microplastics further litter our environment and even enter the food chain when it is consumed by animals. Sustainable Coastlines Hawai'i stressed that every little piece matters.

This event and the overall cause are near and dear to Hickam FCU. In 2021, we partnered with Stephanie Hung of Artists Save Waves to design a beautiful line of debit and credit cards. The designs depict mesmerizing scenes of our local ecosystems. The cards campaign, titled Cards with a Cause, raised $5,000 which was donated to Artists Save Waves and in turn, was used to support Sustainable Coastlines Hawai'i.

2022 College Scholarship Program Awardees

The 2022 Hickam FCU College Scholarship Program awardees posing with Hickam FCU Board members Adrian Yunson, Abigail Nishida, and President/CEO Scott Kaulukukui.

Hickam Federal Credit Union has awarded five $1,000 scholarships and one additional $500 gift for the 2022 College Scholarship Program. These deserving students were selected by the Scholarship Program Committee after a thorough review of their applications, transcripts, recommendations, and more.

The College Scholarship Program normally awards up to five $1,000 scholarships each year. An additional $500 gift was made by a generous donation from the Gamble Ohana in memory of former Hickam FCU Board Member Loretta Keanu. Loretta was a strong supporter of the Credit Union and the education of our keiki.

The awardees and their families were invited to be recognized at the Hickam FCU main office in Pearl City. They shared their college aspirations with Hickam FCU Board of Directors Vice Chair Adrian Yunson, Chief Financial Officer and Secretary Abigail Nishida, and President/CEO Scott Kaulukukui along with Hickam FCU staff members.

2022 College Scholarship Program Awardees

- Kaylin B., Human Development, $1,000 scholarship

- Sydni G., Chemistry, $1,000 scholarship

- Crishelle-Ann I., Nursing, $1,000 scholarship

- Megan L., Biomedical Engineering/Computer Science, $1,000 scholarship

- Kailee T., Biomedical Engineering, $1,000 scholarship

- Chance R., Applied Mathematics, $500 scholarship

Hickam FCU is proud to invest in the academic futures of these deserving students and wishes them the best in their journeys.

Safe Travel Tips

Whether you're traveling thousands of miles to another state or tens of miles to downtown this summer, make sure you're prepared to keep criminals from ruining your fun. Here are tips for protecting your assets and identity.

Protect Your Phone

Your phone contains loads of personal information and access to your accounts. If a thief stole your phone, you could be losing more than just your phone, contacts and photos - your identity could be stolen. Make sure you never leave your phone unattended in public areas and always use a password or biometric lock. Avoid connecting to public Wi-Fi, however if you must, use a virtual private network (VPN) service.

Protect Your Wallet/Passport

When traveling, you need your wallet everywhere you go! Avoid carrying it in your pocket and opt for a bag with anti-theft features. This will keep your wallet safe from pickpockets. After using your wallet, always take the time to make sure your cards are where they belong and that your wallet is properly placed back into your bag.

Passports, on the other hand, should not be carried with you everywhere. Always keep these at home when you are not traveling. While abroad, keep your passport at your hotel room in a secured safe or locked luggage.

Protect Your Home

An empty home is an easy target for thieves. If you are planning to travel, never advertise it to the public. On social media, avoid mentioning your upcoming trips and do not post while you are away. You can always share those awesome photos after you return home. Also be sure to set your social media share settings to just your friends and never befriend people you don't know. Ask a trusted neighbor to keep an eye out on your home or install a home security system. If you have a smart home system, see if you can schedule your lights to turn on for a couple hours each night. This will give the appearance that someone is home and may help deter thieves.